Oct week one

been a very hard week for me this week. broken pc, pc rebuild and its amazing how many small pieces of software that you add to make life easier isnt it - took a bloody age to get most of em loaded.

Im probarbly about 60% of the way there but enough to continue business 100% now anyway - the rest will be added as and when i need em.

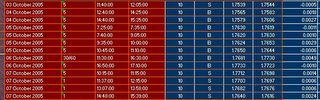

hilda signals from this week are below - bit of a tough week to trade but ive identified and trained the users on am easy way to trade the 1 min chart in a ranging market.

Hilda has an easy way of identifying a ranging market and also tells you when one is forming. as the market ranges most of the time then it was a good idea to find a way to range trade it. This appeared in the form of a pattern and hilda combination so this week im going to concentrate on this in the training room and also get another video done for it.

Lets look at my predictions from last week:

i said ...

This week will begin with yet more downside. Many traders are now bottom picking the market but that does not mean they are right. The setup on the 4 hour chart should play out sometime on monday for shorts although the initial hours of the first day may see upside before the drop

Monday - rise to 1.7680 before fall - if this doesnt happen and we see new highs then 1.78 will be the magic turning point on tuesday / wednesday - by magic turning point i mean a break of 1.78 will see a trend change in the making and if it bounces down from 1.78 then we are in for new lows and a continuation of the downtrend for the week.

well, the prediction for the rise was correct although my first barrier was broken the prediction of 1.7800 was within 13 pips of the weeks high (it reached 1.8013) this took longer than i expected as i did say tuesday - however the fall finally came on Thursday and did indeed make new lows so i think i was pretty damn good on that one :)

the week ahead:

The weekly chart ended on a doji so based on that it's anyones guess as to where the week will end. The monthly chart is still set for an upmove but not to new highs - this will take about 3 or 4 months to complete taking us to february in the new year. 1.8663 is my prediction for a top on the next swign up on the monthly chart - lets see at the beginning of 2006.

The daily shows more downside to the week ahead making new lows again possibly this week down to 1.7300.

The 4 hour chart suggests a rise to 1.7679 on monday before the downside for the week drops into place.

thats it, lets see what happens :)

Obviously the analysis on this page is merely for entertainment purposes only and should not be taken as investment advice - in other words its most probarbly bollocks. :)

take care and check in during the week.

.bmp)

12:16 PM

12:16 PM

Ovia

Ovia